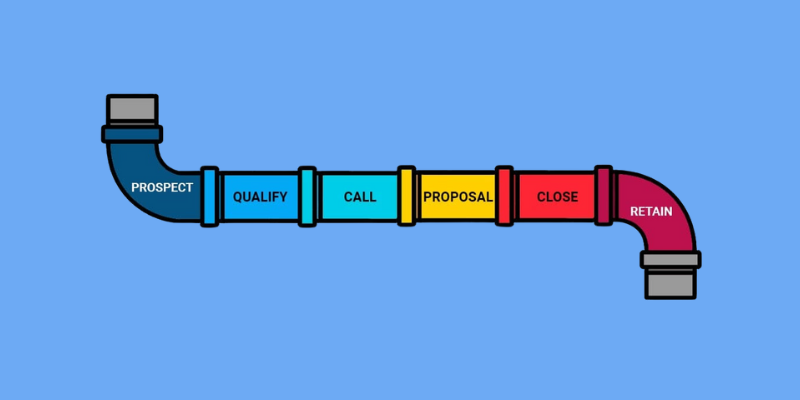

Life insurance agents are vital in providing financial security and protection to individuals and families. However, without an efficient sales pipeline, agents may find it challenging to navigate the complex selling process of insurance policies. In this article, we will explore the ideal sales pipeline template for life insurance agents, including the stages they should have and an example of the customer journey. Additionally, we will discuss why life insurance agents need this sales pipeline template and how it can benefit them in saving time and growing revenues.

7 Lifecycle stages of life insurance leads

Prospecting: Identifying Potential Clients

The sales pipeline begins with prospecting, where life insurance agents seek out potential clients who may require life insurance coverage. Through research and utilizing sources like online databases, referrals, and networking events, agents gather information to determine potential customers’ needs and eligibility, laying the groundwork for future sales conversations.

Qualifying: Evaluating Prospect Interest and Eligibility

After identifying potential leads, life insurance agents make initial contact to gauge interest and assess qualification for life insurance. Agents gather crucial information about the prospect’s financial situation, insurance needs, and goals through conversations and meetings. By asking targeted questions and actively listening, agents gain valuable insights that inform the following sales process stages.

Needs Analysis: Tailoring Coverage to Meet Client Needs

In this critical stage, life insurance agents conduct a thorough needs analysis to determine the ideal type and amount of coverage for each client. Agents can craft personalized solutions that address unique needs and concerns by considering factors such as age, dependents, income, debts, and long-term objectives. This stage demands a deep understanding of various insurance products and their applicability to different life scenarios, enabling agents to provide expert guidance and tailored coverage.

Presenting Quotes: Tailored Insurance Options for Clients

With a deep understanding of clients’ needs, life insurance agents present personalized quotes. This stage clearly explains available policies, features, costs, and benefits. Agents use effective communication tools, such as visual aids, to break down complex information and empower clients to make informed decisions. By highlighting the value and advantages of each option, agents help clients appreciate the importance of life insurance in securing their financial future.

Addressing Rejections: Providing Reassurance

Clients may have questions, concerns, or reservations as they consider their life insurance options. In this stage, life insurance agents provide reassurance and clarity to address these concerns. Agents can establish trust, alleviate doubts, and help clients feel confident in their decisions by anticipating and responding to client worries. Effective communication and empathy are key to building strong relationships and moving forward in sales.

Sealing the Deal: Concluding the Sale

With the client convinced of life insurance benefits, the agent facilitates the application process, ensuring seamless and accurate completion of necessary paperwork. This stage demands meticulous attention to detail and a thorough understanding of administrative procedures. Agents also assist clients in choosing suitable payment options and thoroughly explain policy terms and conditions, providing a comprehensive and satisfying conclusion to the sales process.

Nurturing Client Relationships:

The sales journey doesn’t conclude with the policy sale. Life insurance agents foster lasting relationships by offering continuous support, addressing concerns, and ensuring client satisfaction. Agents demonstrate their commitment to clients ‘ evolving needs through regular communication, updates, and policy reviews. Agents cultivate loyalty, trust, and long-term partnerships by providing personalized guidance and adjusting coverage recommendations as circumstances change.

Here’s an example of a customer journey in a sales pipeline for a life insurance agent:

Step 1: Prospecting

Meet Emily, a 35-year-old married mother of two, at a local community event.

- Exchange contact information and briefly discuss her insurance needs.

- Add Emily to the prospect list for follow-up.

Step 2: Contacting and Qualifying

- Follow up with Emily via phone to discuss her insurance needs in more detail.

- Ask questions to determine her eligibility and interest in life insurance.

- Schedule a meeting to discuss further.

Step 3: Needs Analysis

- Meet with Emily to conduct a comprehensive needs analysis.

- Discuss her financial goals, income, debts, and dependents.

- Identify her need for life insurance to protect her family’s financial future.

Step 4: Presenting Solutions

- Present Emily with personalized life insurance options that address her needs.

- Explain the features, benefits, and costs of each policy.

- Use visual aids to help her understand the options.

Step 5: Addressing Concerns and Building Trust

- Address Emily’s concerns about the cost of premiums and the complexity of the policy.

- Provide reassurance and clarification to build trust and confidence.

- Offer additional resources and support to help her make an informed decision.

Step 6: Finalizing the Policy

- Emily decides to purchase a term life insurance policy.

- Guide her through the application process and ensure all necessary paperwork is completed accurately.

- Explain the terms and conditions of the policy and answer any final questions.

Step 7: Follow-Up and Customer Relationship Management

- Schedule regular check-ins with Emily to ensure her satisfaction with the policy.

- Offer additional services, such as policy reviews and recommendations for adjusting coverage as her circumstances change.

- Nurture the relationship to build loyalty and trust and to identify potential future insurance needs.

Reasons why life insurance agents need this sales pipeline template

- Streamlines the Sales Process: The template provides a step-by-step framework for managing prospects and clients, ensuring no important steps are missed.

- Increases Efficiency: By organizing and tracking interactions, agents can prioritize tasks, reduce administrative time, and focus on high-value activities like selling and relationship-building.

- Enhances Client Experience: The template helps agents provide personalized attention, address concerns promptly, and deliver tailored solutions, leading to higher client satisfaction and loyalty.

- Improves Conversion Rates: By identifying and addressing potential objections, agents can increase the likelihood of closing deals and growing their business.

- Supports Data-Driven Decision Making: The template enables agents to collect and analyze data on their sales pipeline, identifying trends, patterns, and areas for improvement.

- Fosters Consistency and Scalability: As agents grow their business, the template helps maintain consistency in their sales approach, ensuring that all clients receive high service and attention.

- Reduces Stress and Overwhelm: By breaking down the sales process into manageable stages, agents can feel more in control, focused, and confident in their ability to close deals and build long-term relationships.

A strategically designed sales pipeline is the key to unlocking revenue growth for life insurance agents. By understanding clients’ unique needs and concerns at each stage, agents can expertly match them with personalized life insurance solutions. This targeted approach significantly increases the chances of closing more sales, driving revenue growth, and establishing a loyal client base.